Despite China receiving 47 member applications, the U.S. and Japan remain the only two major economies that have not asked to join the bank., the Obama administration now says the new bank could be a good development, but cautioned against its lack of transparency. "This could be a positive thing," President Obama declared at a White House press conference with Japanese Prime Minister Shinzo Abe. "But if it’s not run well, then it could be a negative thing."

Thursday, April 30, 2015

Investors eye on Fed decision today on future interest rate hike.

Stocks fell in Europe, following Asia lower, while the dollar held near two-month lows before the much-anticipated policy decision. "While steady language by the FOMC may not by itself change the mind of the rates market, we believe incoming data will, prompting a front-end sell-off in Treasuries and a rebound in the USD. Investors will again be looking for subtle clues today for the timing of a future interest rate hike as the Federal Reserve's policy-setting committee wraps up its third meeting of the year. The chance of a hike in June is still on the table, although the likelihood of one has steadily decreased amid a drum-beat of soft Q1 economic data. The U.S. Commerce Department is also scheduled to issue its first snapshot of first-quarter GDP this morning. Economists are forecasting growth at a seasonally adjusted annual rate of 1%, which would be the worst performance in a year.

Monday, April 27, 2015

Cap Gemini plans to buy U.S. based iGATE

Looking to make North America its largest market, Cap Gemini plans to buy U.S.-based iGATE for $4B, or $48 per share. The deal, which has been agreed on by both boards, will be financed through a combination of the French company's cash, debt and an equity portion that will not exceed a 6% dilution of its share capital. Cap Gemini also expects the acquisition to enhance earnings by 12% in 2016 and 16% in 2017.

As the monetary easing by central banks across the globe keep yields at rock-bottom, investment officers predict that Japanese demand for U.S. debt won't ease up in the months ahead given the lack of alternatives. Japanese life insurers - some of the world’s largest institutional investors - plan to keep pouring money into U.S. debt this year, WSJ reports, outlining that Japan even overtook China in Q1 as the largest foreign holder of U.S. Treasurys. While the current 2% yield on the U.S. 10-year is a far cry from yields of 5% or more before the financial crisis, it is still miles apart from the 0.16% yield on German bunds and the 0.29% yield on the 10-year Japanese equivalent.

Thursday, April 23, 2015

China's PMI contract to 49.2 in April

China's factory activity declined at its fastest pace in a year, according to HSBC/Markit's Purchasing Managers Index. PMI fell to 49.2 (est. 49.6) in April, beneath the 50-point watermark that separates growth from a contraction. In Japan, manufacturing fell to 49.7 (est. 50.8), dropping below 50 for the first time since July 2014.

Wednesday, April 22, 2015

China's central bank cut the reserve requirement ratio by 100bps

Following the country's soft GDP data last week, China's central bank cut the reserve requirement ratio for all banks by 100 bps to 18.5%, adding more liquidity to the world's second-largest economy to combat slowing growth. China's GDP is still expected to fall to a quarter-century low of around 7% this year from 7.4% in 2014, even with the additional stimulus.

Sunday, April 19, 2015

Saudi Arabia will open its $530B Stock Market to foreign Investments

Saudi Arabia will open its $530B stock market to foreign investments on June 15, giving international investors direct access to the Middle East's largest economy. In 2008, Saudi Arabia began permitting foreign investors indirect access to the market through swaps, but is now looking to fully open the market as it pushes to diversify its petrodollar-dependent economy by boosting the private sector. The Saudi Tadawul Index is up 10% YTD.

Germany's 10 year bond slipped to record low

German government bonds continued to break records, buoyed by the ECB's commitment to stimulus, coupled with investors' appetite for low-risk assets amid growing concerns over Greece. In early trade, the yield on Germany's 10-year bond slipped to 0.070%, breaking through Thursday's all-time low. The yield on the country's 30-year debt was just below half a percentage point. "Liquidity is drying up in Greece," Athens will continue to "compromise for a speedy agreement, but will not be compromised."

Thursday, April 16, 2015

Standard & Poor's has downgraded Greece's credit rating to CCC+

With a negative outlook, citing a substantial risk of a default due to the country's drawn out negotiations with its creditors. "No one has a clue how we can reach agreement on an ambitious program," Germany's finance minister said on Wednesday, adding that Greece's new leftist government had "destroyed" all the economic improvements achieved by Athens since 2011.

Japan to become America's largest overseas creditor followed by China

Japan is set to overtake China as America's largest overseas creditor when the U.S. Treasury releases its February investment figures in Washington. China cut its investment in Treasuries for a fifth month in January, while Japan added $7.7B, narrowing the gap to $1B. While the two Asian nations each own almost 10% of the $12.6T in publicly traded U.S. debt, China has held more than Japan since 2008.

Tuesday, April 14, 2015

Whether its an end of road for Greece?

Greece is preparing to take the dramatic step of declaring a debt default unless it can reach a deal with its international creditors by the end of April, FT reports.If the Europeans won't release bailout cash, there is no alternative [to a default]," one government official said. Athens has also decided to withhold €2.5B of payments due to the IMF in May and June if an agreement is not struck.

The U.S. Budget defecit up by 43% YOY.

The U.S. ended the month of March with a budget deficit of $53B, up 43% from the same period last year, bringing the current fiscal YTD deficit to $439B at the end of last month. Meanwhile, Fitch has affirmed the U.S.'s long-term default ratings at "AAA," citing the country's "unparalleled" financing flexibility as the issuer of the world's pre-eminent reserve currency and benchmark fixed-income asset. Fitch also expects the U.S. to grow 3% in 2015, before decelerating slightly in 2016.

Monday, April 13, 2015

India's IIP increase 5% in February

Industrial production for February 2015 grew at 5% YoY (vs. +2.8% in January 2015) - highest growth in the past nine months.

Core industries grew at a tepid pace of 1.4% YoY.

Capital goods' growth trend up, indicating improving investment in the economy.

The industrial production for February 2015 moved up, printing a growth of 5% YoY, compared to 2.8% YoY in January 2015. This is the highest growth recorded in the past 9 months. Core industries (constituting 38% of industrial output) grew at a tepid pace of 1.4% YoY during the month.

Industries constitute 45% of banking sector credit; growth in industrial production is a key positive for banks.

Industry-wise growth

Manufacturing, constituting 75% of the industrial production index, expanded 5.2% YoY, against 3.4% in the previous month. Mining grew at 2.5% YoY (January 2015: contraction of 2%), while electricity generation registered a 5.9% growth YoY (January 2015: 3.3%).

Monetary and fiscal policies are in easing mode; growth momentum is expected to continue.

China advised Taiwan to become a founder member of AIIB under the name "Taipei, China."

China has rejected Taiwan's bid to become a founding member of the Asia Infrastructure Investment Bank under the name "Chinese Taipei," but said the island would be welcome to apply again as an ordinary member in the future. The two have been tied up over an "appropriate name" under which Taiwan can join the bank. Although China views Taiwan as a renegade province, it allows it to participate in the Asian Development Bank under the name "Taipei, China."

Concerns over the damaging side effects of ECB's QE program

Raising new concerns over the damaging side effects of the ECB's landmark QE program, many analysts now think it is only a matter of time before Germany's benchmark 10-year government borrowing costs drop below zero for the first time. Yields on the Bunds fell to just 0.15% today, compared with 0.54% at the start of the year, as the ECB entered the second month of its €1T bond-buying program. Although not part of the eurozone, Switzerland became the first government in history last week to sell benchmark 10-year debt at negative interest rates, raising even more worries about distortions in the global financial markets.

China's export plunged by 15% in march followed by imports

China's exports surprisingly tumbled in March while import shipments fell at their sharpest rate since the global financial crisis, setting a poor precursor to the country's closely-watched Q1 GDP figure due on Wednesday. According to official data, Chinese exports plunged 15% and imports fell 12.7% last month in dollar terms as weak demand and the impact of the lunar new year weighed heavily on Chinese factories. The soft trade figures sent Chinese shares higher, with the Shanghai Composite closing up 2.2%, as investors bet on more stimulus from Beijing.

Sunday, April 12, 2015

Euro accounts for just 22% of global reserves,6% down from pre crisis level

Central banks cut their euro holdings by the most on record last year to help mitigate losses ahead of the ECB's QE. The euro now accounts for just 22% of global reserves, down from 28% before the EU's debt crisis five years ago, according to the IMF. "As a reserve currency, the euro is falling apart". The numbers may be music to Mario Draghi's ears - a cheaper currency is theoretically a more competitive one - but Mizuho suggests the euro's slipping popularity suggests a more lasting loss of confidence in the EU economy.

Thursday, April 9, 2015

German's PMI showed strong reading in March

German exports recovered smartly in February, growing 1.5% on month after falling 2.1% in January and beating consensus of +1%. Imports increased 1.8% following a decline of 0.2% and the trade surplus rose to €19.7B from €19.6B. Meanwhile, industrial production increased 0.2% on month, as expected, after slipping 0.4%. The figures come after data yesterday showed that factory output weakened in February, although PMI readings in March were strong.

Meanwhile,European stocks were higher at the time of writing following the positive German data and yesterday's release of the FOMC minutes, which provided little clarity on when the Fed might hike rates but were deemed sufficiently dovish. Reports about Greece's €450M repayment to the IMF has also added to the positive sentiment. In Asia, Hong Kong stocks had another banner day as investors looked to exploit cheap prices in relation to the mainland.

Greece has made a €450M loan repayment to the IMF, Bloomberg reports, although other outlets just say that the country will make the payment today. The government had threatened to miss the deadline in order to avoid defaulting on "their own people" - Greece also needs to pay €1.7B in wages and pensions at the end of this month - but seems to have backed down.

Euro zone partners gave Greece six working days to improve a package of proposed reforms in time for finance ministers of the currency bloc to consider whether to release more funds to keep the country afloat when they meet on April 24.

Euro zone partners gave Greece six working days to improve a package of proposed reforms in time for finance ministers of the currency bloc to consider whether to release more funds to keep the country afloat when they meet on April 24.

Wednesday, April 8, 2015

Shell has agreed to purchase BG Group for $70B.

Shell has agreed to purchase BG Group for £47B ($69.6B) in a cash-and-stock deal that will add 25% to Shell's proven oil and gas reserves and 20% to its production. The acquisition will also improve the latter's prospects in new projects, particularly in Australian LNG and Brazilian deep water. With Shell paying a premium of 52%, BG Group's shares surged 37% in London, although Shell fell 1.55% premarket in the U.S.

A blockbuster deal to buy BG Group for $70B, with the Europe 600 Oil & Gas index +5.2% at the time of writing. However, although the deal pushed the FTSE 100 higher, the rest of Europe was looking pretty down as the poor German factory figures acted as a bit of dampner.

German factory orders dropped 0.9% on month in February, which badly missed consensus of +1.5% but did represent an improvement from a 2.6% slump in January.

Stocks surged in Asia amid an atmosphere of monetary easing, while U.S. futures were up ahead of the release of the minutes of the latest Fed meeting, which will be scrutinized for clues about when the bank might increase rates.

Saudi Arabia raised oil output to 10.3M barrels a day in March

Saudi Arabia raised oil output to 10.3M barrels a day in March, the highest in at least 12 years, and intends to keep producing 10M bpd despite low crude prices. Oil minister believes that oil will rise in the "near future" but even if it doesn't, some expect the kingdom to hold firm until the slump in crude forces U.S. shale plays into bankruptcy.

The Nikkei rose 0.8%,the highest close since April,2000

The Nikkei has hit a 15-year high after the Bank of Japan kept its monetary spigots on at full blast, with the BOJ's board voting 8-1 to maintain its asset-purchase target at ¥80T a year. As in the U.S., all that money printing has caused an inflation in assets - if not in consumer goods and services - and the Nikkei rose 0.8% to 19,789.81, the highest close since April 2000.

Moody's ups India's rating outlook to positive from stable

Rating agency Moody’s has affirmed India’s sovereign rating at BAA3, but raised the rating outlook to ‘positive’ from ‘stable’.

“The Baa3 rating incorporates the risk that higher levels of growth and infrastructure development will be accompanied by higher leverage.

Sovereign credit improvements over the next 12-18 months will depend on the extent to which growth, policies and buffers can contain the risks associated with rising leverage.

However it cautioned that unless the country’s banking system woes were resolved, its credit profile would remain constrained.

Moody’s view is that India’s policymakers are establishing a framework that will likely allow India’s growth to continue to outperform that of its peers over medium term and improve India’s macro economic, infra and institutional profile.

The rating agency said there was increasing probability that actions by policy makers will enhance the country’s economic strength, and by extension, the sovereign’s financial strength over coming years.

S. 80HHC: It is a pre-requisite that there must be profits from the export business. If the exports business has suffered a loss, deduction cannot be allowed from domestic business

Jeyar Consultant & Investment Pvt. Ltd vs. CIT (Supreme Court)

From the scheme of Section 80HHC, it is clear that deduction is to be provided under sub-section (1) thereof which is “in respect of profits retained for export business”. Therefore, in the first instance, it has to be satisfied that there are profits from the export business. That is the pre-requisite as held in IPCA and A.M. Moosa as well. Sub-section (3) comes into picture only for the purpose of computation of deduction. For such an eventuality, while computing the “total turnover”, one may apply the formula stated in clause (b) of subsection (3) of Section 80HHC. However, that would not mean that even if there are losses in the export business but the profits in respect of business carried out within India are more than the export losses, benefit under Section 80HHC would still be available.

Tuesday, April 7, 2015

UK service PMI jumped to 58.9 in march

U.K. services PMI jumped to a seven-month high of 58.9 in March from 56.7 in February, boosted by a stronger rise in new business. The latest PMI surveys indicate that the economy grew 0.7% in Q1 following a slowdown late last year. "Faster growth of new business and improved expectations...bode well for the upturn to retain strong momentum," says Markit. The pound was -0.1% at $1.4866 at the time of writing

Eurozone PMI rose ahead in march to 54.2.

Eurozone business activity powered ahead in March, with eurozone services PMI rising to 54.2 from 53.7 in February, while the composite figure increased to an 11-month high of 54 from 53.3. "Ireland and Spain continued to lead the charge, backed up by a fast-improving German economy," says Markit, but "rates of expansion in Italy and France were modest in comparison." The PMIs indicate Q1 GDP growth of 0.3%, although "the pace of expansion looks set to gather pace." The euro was -0.6% at $1.0853 at the time of writing.

Monday, April 6, 2015

RBI kept repo rate unchanged.

The market remained lacklustre post announcement of RBI policy. The Reserve Bank of India kept repo rate unchanged at 7.5 percent and cash reserve ratio at 4 percent.

RBI says retail inflation will remain below 6 percent in FY16. "CPI inflation is expected to fall to 4 percent by August but firm up to 5.8 percent by year-end."

The Reserve Bank says GDP growth under new methodology is seen at 7.8 percent in FY16.

RBI feels the outlook for growth is improving gradually. Comfortable liquidity conditions should enable banks to transmit the recent reductions in the policy rate into their lending rates, thereby improving financing conditions for the productive sectors of the economy.

Oil jumped more than 5% on monday- Hedge funds increased bullish oil bets.

Oil prices jumped more than 5 percent on Monday as traders reassessed how quickly Iran might increase exports after a preliminary nuclear deal and anticipated that a months-long rise in U.S. crude inventories may be slowing.

Brent crude's rally followed Thursday's nearly 4 percent tumble after Iran and six world powers announced a framework agreement on the OPEC member's nuclear programme. But initial expectations of a quick recovery in oil exports were tempered by views that it could take longer than expected to roll back sanctions.

Hedge funds increased bullish oil bets by the most in four years as negotiators worked to reach a deal over Iran’s nuclear program. Speculators boosted their net-long position in crude by 21% during the seven days ended March 31, CFTC data show, the biggest percentage increase since March 2011. Short positions declined by the most in three months.

Sunday, April 5, 2015

Transfer Pricing: Entire law on determining ALP of transaction of loan of money to AE discussed

CIT vs. Cotton Naturals (I) Pvt. Ltd (Delhi High Court)

The question whether the interest rate prevailing in India should be applied, for the lender was an Indian company/assessee, or the lending rate prevalent in the United States should be applied, for the borrower was a resident and an assessee of the said country must be answered by adopting and applying a commonsensical and pragmatic reasoning. We have no hesitation in holding that the interest rate should be the market determined interest rate applicable to the currency concerned in which the loan has to be repaid. Interest rates should not be computed on the basis of interest payable on the currency or legal tender of the place or the country of residence of either party. Interest rates applicable to loans and deposits in the national currency of the borrower or the lender would vary and are dependent upon the fiscal policy of the Central bank, mandate of the Government and several other parameters. Interest rates payable on currency specific loans/ deposits are significantly universal and globally applicable. The currency in which the loan is to be re-paid normally determines the rate of return on the money lent, i.e. the rate of interest

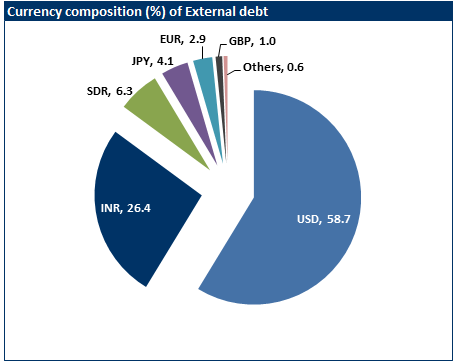

External debt of India rose US$ 6 billion QoQ, to US$ 462 billion by end of Dec'2014.

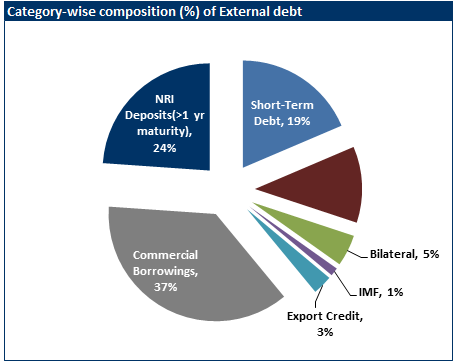

India's external debt rose to USD 462 billion at the end of Dec'2014, up from USD 456 billion at the end of Sep'2014. This is 8% higher than USD 427 billion, a year ago. The increase was driven by Commercial borrowings, which now constitute 37% of total external debt (up from 20% in Sep'04).

Forex reserve at the end of Dec'2014 was USD 322 billion (This has risen to USD 340 bn recently).

Forex reserves currently at US$ 340 billion; Looks adequate. Forex reserve as a percentage of total external debt increased to 70%. As a percentage of non-Rupee debt, forex reserves rose to 95% from 91% in Sep'2014, a key positive for the Rupee (NYSEARCA:INR) as it lowers the pressure on the forex reserves.

Source: Ministry of Finance

Commercial borrowings constituted 37% of total external debt, followed by Deposits from non-resident Indians' deposits ((24%)) and Short term debt ((19%)):

Source: Ministry of Finance

Decrease in share of non-INR debt is a positive.

Forex reserves might see pressure if maturing forex debt does not get refinanced by fresh forex borrowings.

Rupee to trade at 61-63 in the near-term; Year-end target at INR 65/USD.

Thursday, April 2, 2015

U.S. equity-index futures dropped with the dollar on weaker-than-estimated data on hiring and manufacturing

U.S. equity-index futures dropped with the dollar on Thursday, the last trading day of the week for many markets before the Easter holiday season. Despite many investors sitting on the sidelines prior to the weekend, markets are preparing for the monthly U.S. jobs report for clues on monetary policy. The figures will follow yesterday's weaker-than-estimated data on hiring and manufacturing, which fueled speculation that the U.S. economy is slowing and bolstered the case for keeping interest-rates lower for longer.

Wednesday, April 1, 2015

Euro area manufacturing PMI hits 10 month high in march

Euro-area manufacturing expanded faster than initially estimated last month, helped by growth in Spain and Italy and a stronger performance in Germany. Beating an earlier "flash" reading of 51.9, Markit's Purchasing Managers Index hit a 10-month high in March, rising to 52.2 from 51 in February. Economic momentum in the eurozone is picking up as the ECB continues its €60B a month QE program and a weaker euro aids exporters.

Subscribe to:

Posts (Atom)